What You Need To Know About Dropshipping In Australia In 2021

Australian population exceeds 25 million, which makes this market really tempting for online entrepreneurs. Let’s look closer at dropshipping in Australia and find out the opportunities this country opens up for online store owners.

I know what you might be wondering about.

Ecommerce keeps booming around the globe. So, how possible is it to run an online business in Australia?

Well… What if I told you that it’s 500% possible?

Yeah, you get it right!

Australia is a perfect place for ecommerce. You can easily cope with five online stores that earn you enough money to lead a lifestyle you’d like to.

And if that sounds implausible for you, the story of Flo from Melbourne can put your doubts to rest. She’s successfully running five dropshipping stores while travelling around the world.

That’s the beauty of this business model. You shouldn’t invest much money to start this business. There is no need in buying products in advance and having any inventory to store them. All the necessities are a laptop and special software.

Thus, you’re not tied down to a certain place. You can run your ecommerce business and enjoy doing whatever you like to your heart’s content.

Great, isn’t it?

So, let’s take a deeper look and find out all the ins and outs of dropshipping in Australia!

A short guide to dropshipping in Australia

#1 How to choose the best suppliers

The dropshipping business model is great and easy to implement.

But it’s only true if you have a reliable business partner who takes care of storing products and shipping them to your customers. Put simply, you should pick a supplier for your dropshipping store who won’t let you down.

The question is, how to find them if you’re an Australian?

The most commonly used options are:

- To look for suppliers on dropshipping directories

- To team up with AliExpress sellers

What is a dropshipping directory?

Well, it’s a database of wholesalers or manufacturers which credibility is verified by a special procedure. So, you can pay some fee to get access to this database and choose your business partners. Chances are, you’ll come across suppliers based in Australia.

However, this method poses some difficulties for entrepreneurs, especially for those who are making their very first steps in dropshipping.

Ok… what about AliExpress?

There is a countless number of sellers offering the widest range of items. You’ve got everything you need to check the credibility of AliExpress sellers. And when it comes to the lowest prices, AliExpress is unbeatable.

Well, it’s a good idea to choose your suppliers from there, isn’t it?

What could hold you back is that Australia is quite remote from China. International shipping takes some time. So, it may seem that the long delivery can harm your online business.

Actually, it’s not the case. Yet, if you could speed up the process, it would give you a serious edge over your competitors, wouldn’t it?

Of course. And the good news is that you can pull it off!

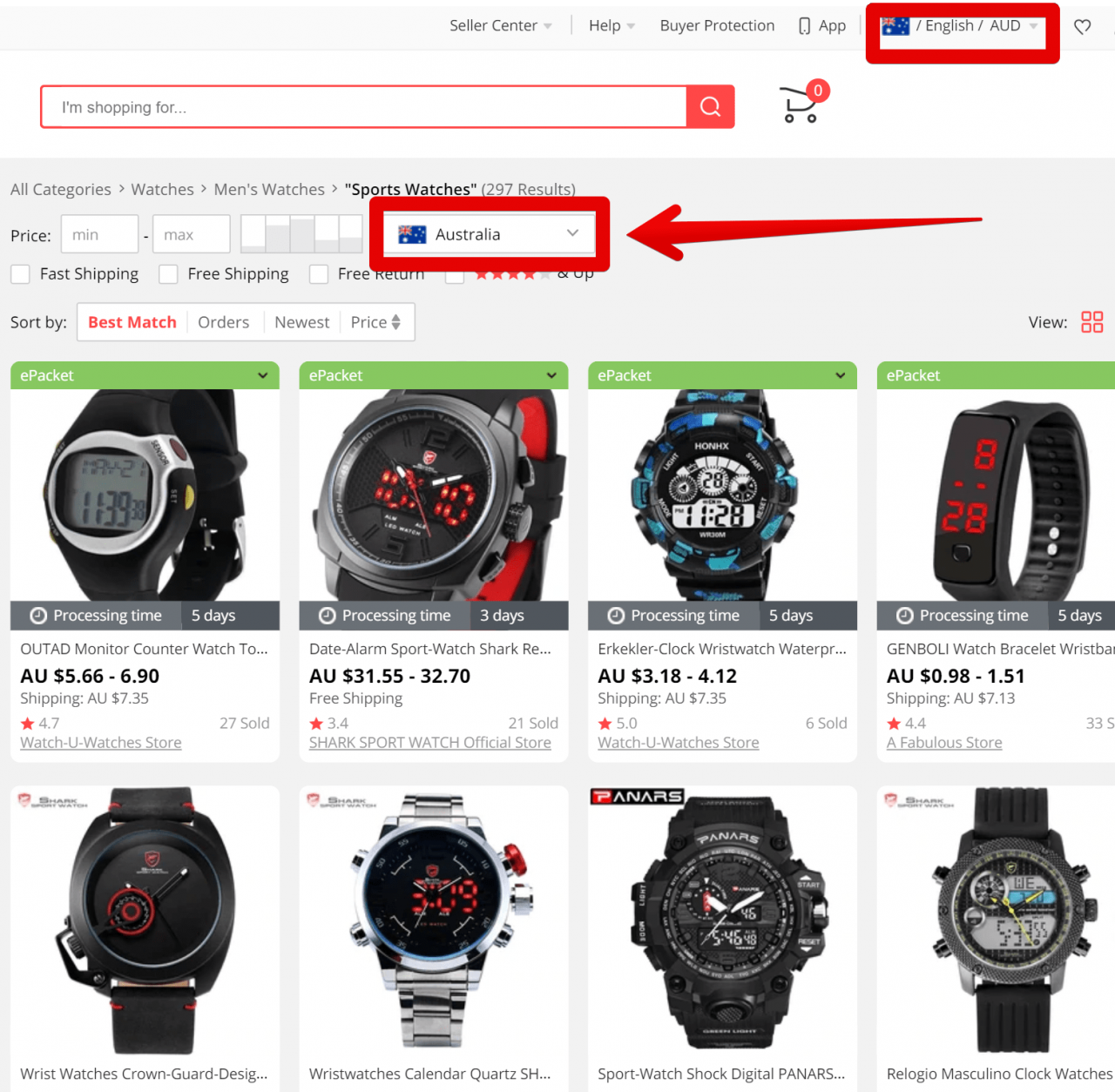

We’ve already told you how to search for the AliExpress sellers storing their goods in the USA and Europe. So, the same goes for Australia.

You can easily find Australian dropshipping suppliers by changing “China” to “Australia” in the “Ship from” field on AliExpress as it is shown in the picture below.

And when you know which supplier has warehouses in Australia, you can partner with them, reduce your shipping time and make your dropshipping business flourish.

#2 How to register your dropshipping business

When you’ve made up your mind about the products to sell and found suitable suppliers, you can move on to launching your dropshipping business.

In short, you should come up with a name for your online store, choose your domain and hosting provider, set up your website and register your venture.

For those who are just starting their dropshipping journey, the most suitable business structure is Sole Trader. It has minimum requirements and the lowest cost to start.

If you’re an Australian citizen, you could be a good idea to obtain an Australian Business Number (ABN). When you have your ABN, you can register your business name, choose an Australian domain like “.com.au”, pay your duties and taxes and so on.

To get your ABN and find out more information on the topic, you should visit Australian Government website and make online application. The procedure is free and usually doesn’t take much time.

#3 What taxes you need to pay in Australia

If you’re an online store owner in Australia, you must follow the law and pay taxes to avoid legal problems.

Every Australian business faces two major types of taxation.

The first one is income tax – a certain percentage of your income you must pay to the government.

There is a progressive tax system in Australia. That means, the more you earn – the more you pay.

You’ve got five tax brackets like rungs on the ladder. Each bracket has its tax rate. And as your income exceeds a certain amount and moves to the next rung, the tax rate you pay for this extra income increases.

So, if you earn $18,200 or less, your tax rate is 0% and you pay nothing in taxes. But, if your income is from $18,201 to $37,000, you must pay 19c for each dollar over $18,200 (your tax rate increases to 19%). However, you still pay 0% for the first $18,200.

It works the same way for the next tax brackets. The tax rate on your income from $37,001 to $90,000 is 32,5%; 37% on $90,001 to $180,000; and 45% on the income over $180,000.

The second type of taxes you face in Australia is sales taxes or GST (Goods and Service Tax). You include this tax in your products’ prices to collect and pass them to the government.

Luckily, Australian tax system is not so complicated as it’s in the USA or Canada. So you don’t have to scratch your head calculating the amount of GST you need to charge. It doesn’t vary depending on the state and stands at 10% regardless of the city your Australian customers are from.

Moreover, you can put off dealing with your sales taxes and focus on growing your dropshipping business. Australian entrepreneurs don’t have to register for GST and collect it until their revenue reaches $75,000 in 12 months.

To find more comprehensive information on Australian tax regulations, you should visit the Australian Taxation Office’s website.

Please, note: any information we give you on tax requirements and regulations cannot be considered as a legal advice. To handle your taxes properly in full accordance with the country law, we recommend you to consult your local lawyer.

#4 Dropshipping to Australia

Many online entrepreneurs want to learn about importing products to Australia before they start selling them to Australian customers.

Well, let’s take a look at the issue.

The first thing you need to know is that all goods purchased online with a value of $1,000 or less are considered as low value products. And according to Australian border laws, purchasing such products is duty-free.

However, if Australian consumers bring your online store $75,000 or more, you must charge GST even for the low value products you sell. No matter whether you’re an Australian resident or a foreigner, you need to register for GST in Australia and collect it.

You can visit the Australian Tax Office’s website and learn who is obliged to charge GST in detail.

Yet…

Those who choose to dropship with AliExpress are in for a treat! This online marketplace takes care of collecting GST for Australian government and dealing with all the necessary documents.

For example, if you’re a US citizen dropshipping goods to Australia from AliExpress, you don’t need to worry about paying GST at all. AliExpress will take care of that and your Australian clients will get their purchases safe and sound.

#5 Dropshipping to other countries

If you run your online store from Australia, it doesn’t mean that you’re limited to Australian market.

Actually, going global can be more beneficial for your dropshipping business. There is plenty of promising markets to target around the globe such as the USA, Europe, Canada, India, etc.

Aside from that, you don’t need to keep tabs on your GST turnover while selling your products to other countries. Since your sales take place outside of Australia, there is no need to worry about charging this type of taxes.

For instance, you can focus on the US customers, who are allowed to purchase tax-free up to $800 (USD) while shopping online. This way, you can be sure that your US clients won’t face any additional taxes or custom duties when receiving their packages. Thus, they will stay pleased and your dropshipping business will thrive.

However, some countries like Canada has a very low import limit for online purchases. So, if you target such countries, you should let your customers know that there could be some extra fees they need to pay when their packages arrive.

Conclusion

If you’re thinking of starting your dropshipping business, Australia is perfectly fit for that. As you can see, this country has great prospects both for local and foreign entrepreneurs. So, you can launch your online store and seize your share of Australian market.

We hope this article has given you the answers to the most burning questions about dropshipping in Australia. If you still have something to ask, please leave your comments in the section below. We’ll try to clear it up for you!

tutorials and special offers from AliDropship

Great post with some valuable info!

Just a question in regards to taxes – do I need to register for GST if I am only selling to countries outside of Australia and my annual revenue is over 75K?

Thanks 🙂

Hi, Andrew!

Thank you for your question.

Unless you sell to Australian customers, you don’t need to charge GST regardless of the amount of your revenue.

Hi, great article.

Is there a tutorial for setting up Tax options in Woocommerce for Australia?

This model is getting harder and harder to achieve. Believe me I am a supplier and dropshipper too. Aliexpress is no longer a secret for the few. It’s now open to the public. And with their crazy Black Friday sales, who would not know about them. More and more people are going direct to Aliexpress. You have to improvise like create a Premium Supplier Group. Just my two cents.

Hi, I am from Argentina, living in Australia. My questions in regards to taxes- Do I need to register in GST if I sell my products inside Australia but my income is lees than $75.000 per year?

Great Post! Very cleat

Hi, thank you for your feedback! No, it won’t be necessary.

Hey, Thanks for the content. I have a question about selling both Australian and international markets, it is my understanding you wont have to register GST only if revenue from Australian customers reach the $75,000 threshold. For example 100k international and 50k Australian sales overall 150k you wont need to register for GST?

Hey Andrey, great post!

I have a big question concerning taxes.

The dropshipping business model means that my client would be paying me an amount that is not actually my real income. My real income would be the difference between the price of the product in my page and the price of the product in the supplier’s page.

Therefore, the tax will be applied to my real income or to the income that I received from my costumers?

Thank you!