5 Must-Know Things About Dropshipping In Canada

What are the essentials entrepreneurs need to know to start dropshipping in Canada? Let’s see!

If you’re a Canadian, you must be a lucky one.

Not only because of the last Happiness report where Canada ranks ninth, but also because of the opportunities this country opens up for online businesses.

Indeed, out of 35.5 million Canadian citizens, 35 million are the Internet users. That makes Canada one of the largest online markets in the Americas. Thus, many people are eager to try their hand at ecommerce.

That’s why we decided to outline the most essential things about dropshipping in Canada that will come in handy for those who are about to give it a try.

So, let’s move on to them!

What entrepreneurs should know about dropshipping in Canada

#1 Canadian eCommerce market

The first thing online entrepreneurs need to know about dropshipping in Canada reflects the common tendency in the world. Ecommerce industry is constantly growing.

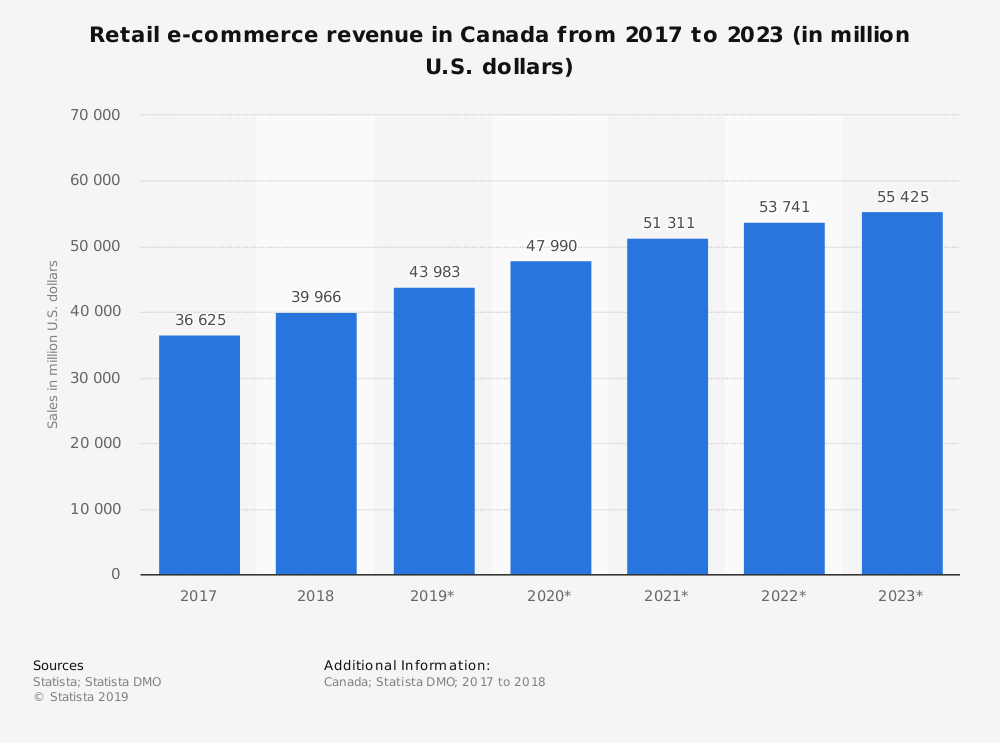

According to a report by Statista, retail ecommerce revenue almost reached $40 billion in 2018 showing more than $3 billion growth from 2017.

Moreover, it’s promised to surpass $55 billion in 2023. So if you’re wondering what the best time to start your online business in Canada – there’s no time like the present.

#2 Business registration

As a Canadian citizen who wants to rule out unnecessary problems while dropshipping there, you should make your business legal.

There are three main business structures in Canada:

- Sole Proprietorship

- Partnership

- Corporation

Sole Proprietorship is the most appropriate for those who are making their very first steps in ecommerce. Choosing this option, you operate under your own name and don’t need a business licence. Thus, you get around applying for a Business Number from the CRA (Canadian Revenue Agency), which makes your dropshipping journey much easier to start.

However, you may be wondering – how can I find a supplier for my online store? Many wholesalers require you to have your business number and go through some legal procedures to cooperate with them, don’t they?

Right! But if you decide to find suppliers for your dropshipping business on AliExpress, you don’t need anything of that sort. There, you can easily find reliable business partners, add their products to your store and it’s in the bag!

As long as the value of the products bought from your store is $20 (CAD) or less, they can cross Canadian border custom-free. If you work with AliExpress suppliers, finding such items is a piece of cake, isn’t it?

Yet, if the value exceeds $20, you should let your customers know that they could face some additional fees after the delivery or…

You can find a supplier that stores the goods in the USA and push up the limit. In 2018, the US and Canada made a deal. Since then, all the products which value doesn’t exceed $150 can be imported from the United States to Canada without any additional payments.

#3 Income taxes in Canada

Canada is the country with ones of the highest living standards in the world. And its prosperity rests on the tax system.

If you’re a Canadian citizen and decide to start your online business, you should be ready to pay the income tax.

Canada has a progressive tax system. To be more precise, there are five tax brackets depending on the amount of your income. As you move to the higher bracket, you pay more taxes for your additional income.

Let’s look at that closer. If you earn up to $47,630 per year, you tax rate is 15%. But on the next $47,629, you’ll have to pay 20,5%. In other words, for each dollar you earn above $47,630, you should give 5,5% more in taxes than for previous ones.

For instance, if your dropshipping store makes $84,000 per year, you pay $7,145 (15%) in taxes for the first $47,630 and $7,456 (20,5%) for the rest $36,370 of your income.

Here are all five Canadian income tax rates for 2019:

- 15% on the first $47,630

- 20,5% on the income over $47,630 to $95,259

- 26% on the next $52,408 (up to $147,667)

- 29% is charged from $147,667 to $210,371

- And 33% on the income above $210,371

#4 Sales taxes while dropshipping in Canada

Besides paying income taxes, Canadian entrepreneurs must pay sales taxes. Or, to be more accurate, they should collect these taxes and pass them to the government. The thing is, it’s Canadian customers who actually bear the brunt of paying them. You just need to include these taxes in your product prices.

At first glance, sales tax system in Canada looks a bit complicated and daunting and could scare off dropshipping entrepreneurs. But you just need to take a closer look to understand that it’s not the case.

So, let’s break it down!

Actually, Canada has two systems of sales taxation for business. The first one is federal (GST – goods and services tax) and you pay it to the federal government. It stands at 5%.

The second system is provincial (PST – provincial sales tax). You collect it for the local government. And it ranges from 0% to 10% depending on the province.

There is one more type of taxes called HST (harmonized sales tax). In fact, HST combines GST and PST to make one tax. The federal government charge this tax on behalf of the province and then gives the local government its share.

So, Canada has 10 provinces and 3 territories. And it depends on the province or territory you run your business which tax you collect. It can be either only GST, the combination of GST and PST, or HST.

Sales taxes by province in Canada

According to the official website of Government of Canada, the rates of tax to charge are allocated for separate provinces and territories in the following way:

- GST of 5% for Alberta, British Columbia, Manitoba, Northwest Territories, Nunavut, Quebec, Saskatchewan, and Yukon

- HST of 13% for Ontario

- HST of 15% for New Brunswick, Newfoundland and Labrador, Nova Scotia, and Prince Edward Island

That’s not a rocket science, right?

But…

When it comes to dropshipping business, the collection of taxes could seem to be a bit difficult.

Let’s suppose your business is registered in Ontario, but your buyers are from British Columbia. That means that you sell and deliver the products out of your province or territory. Thus, you must charge not 13% HST set in Ontario, but 12% HST that applies to British Columbia.

That’s why some entrepreneurs could get cold feet, though this problem can be easily solved with special ecommerce software.

For example, if you use AliDropship plugin, you can set the necessary tax rate for each city you clients could be from in advance. And if you choose Woo version of the plugin, you can install software like TaxJar that is going to manage your taxes automatically.

Please note: Any information we give on tax requirements and regulations cannot be considered as expert advice. To handle your taxes properly and avoid legal problems, you should address the issue to professionals.

#5 Dropshipping to other countries

As you can see, the tax issue in Canada is not as complicated as it could seem. However, it would be great to avoid it, at least for a while, wouldn’t it?

Well… actually, it’s possible.

Canadian entrepreneurs don’t have to pay GST or HST before their annual revenue reaches $30,000. And some provinces also exempt you from sales taxes (PST) if your revenue is below a certain amount. Thus, you can put off dealing with sales taxation until your online store picks up enough steam.

And it’s not the only way!

The good news is that if you’re a Canadian entrepreneur and dropship goods to some other country, you can forget about paying sales taxes.

Indeed, if you target, for example, US customers, you don’t import your products to Canada as well as export them from the country. Your suppliers’ warehouses are located in China or in the USA.

Moreover, US online shoppers are allowed to purchase tax-free up to $800. So you don’t need to worry about angry customers complaining about unexpected custom fees when receiving their packages.

Summing it up

So, if you a Canadian looking for ways to become financially independent and live a full life, dropshipping is definitely a way to achieve that. Canada’s got everything you need to launch your online business.!

We hope this article will help you start dropshipping in Canada and lead your business to success. If you’ve got more questions on the topic, feel free to leave them in the comment section below.

tutorials and special offers from AliDropship

But this is unfair because simply the Canadian customer will simply shop for the same product from a Chinese based online store TAX FREE ( No sales tax)

So Canadian online store is less competitive by charging sales tax to customers.

To make it fair Ecommerce should only pay income or more specific income on net profit Not on total revenue because revenue has cost of goods in it

Thank you

Hi, thank you for your insight!

Kindly remember that a store based in Canada doesn’t necessarily have to serve and target Canadian customers only. Instead, it’s possible to focus on clients in any other part of the globe – for example, the ones that have a limited offline access to the products offered in the store.

When you mention the annual revenue of 30 000$ limit before the need of collecting taxes. Does 30000$ include all sales made in canada and international? Or is it 30000$ revenue of solely canadian sales?

Hi, thank you for your interest! It’s the whole annual revenue, therefore, it includes all sales regardless of their place of origin.

How about people outside of Canada wanting to sell in Canada? What are the requirements?