5 Dropshipping UK Questions You Wanted Us To Answer [Updated in 2021]

Want to start a dropshipping business in the UK? Interested in selling goods to this country? In this article, we’re going to give you the answers to the most burning questions about UK dropshipping!

The UK is the home of progress. It is the country that once turned the tide and changed the world once and for all.

Indeed, the industrial revolution began exactly in Great Britain and spread around the globe at breakneck speed.

Today, the digital revolution is taking over the world at an even greater pace. And obviously, the UK can’t stand aside while it’s happening.

There are close to 70 million people living in this country, all the necessary civil liberties, and a stable and fast Internet connection. In other words, Great Britain is a great market for ecommerce entrepreneurs.

The only thing that can keep you from starting your UK dropshipping business is a lack of information.

To fill that gap, we’ve decided to answer the most commonly asked questions about UK dropshipping.

So, let’s start!

Disclaimer: This article reflects the political situation in the UK and the post-Brexit business environment as per February 2021. We strongly recommend that you consult your local lawyer and get expert legal advice if you’re looking for more relevant data.

#1 Do I need to register my dropshipping business in the UK?

Is dropshipping legal in the UK?

Yes, dropshipping is just a business model, so it’s totally legal. Does it mean that, if you want to start a dropshipping business in the UK, you have to register it?

This question bothers most UK-based dropshipping newcomers.

And the short answer is yes. You do need to register your online venture in the UK if you want to get around any legal consequences. The good news is, it’s not a big problem.

There are three basic business structures in Great Britain:

- Sole Trader

- Partnership

- Limited Company

If you want to figure out what each of them implies, you can easily find the necessary info online. Yet, I’ll take the liberty of saying that the most suitable option for dropshipping store owners is to become a sole trader.

It’s really easy and fast to set up this business structure and operate it. You just need to register with HM Revenue & Customs for self-assessment and tax returns and you’re good to go.

#2 How can I find the best suppliers for UK dropshipping?

It’s hard to downplay the importance of reliable dropshipping suppliers for your business success.

The quality of the products you sell, your customers’ satisfaction, and many other things depend on the suppliers you cooperate with. So, looking for a credible business partner could be a real pain in the neck for online entrepreneurs.

You can find many companies offering dropshipping services to suppliers’ databases on the Internet. However, it can be quite difficult to team up with such suppliers.

Usually, they have a list of requirements you need to live up to. Aside from that, there could be some legal procedures you have to undergo that are too burdening for newcomers.

That’s why AliExpress is a perfect solution for dropshipping entrepreneurs. This way, you don’t need to comply with any requirements to start selling the goods. All you need to do is install special software, choose trustworthy AliExpress suppliers and add their products to your online store.

Another common issue related to UK dropshipping is delivery time. As of now, shipping from China to the United Kingdom with free delivery options and even a number of paid options takes 20-50 days. A number of AliExpress suppliers offer faster shipping options, but in these cases, delivery can cost up to $50. Considering that dropshipping expensive goods is much more difficult than selling affordable ones, these options can hardly be viable.

However, the long shipping time from China is not a big problem. Moreover, you can easily reduce it!

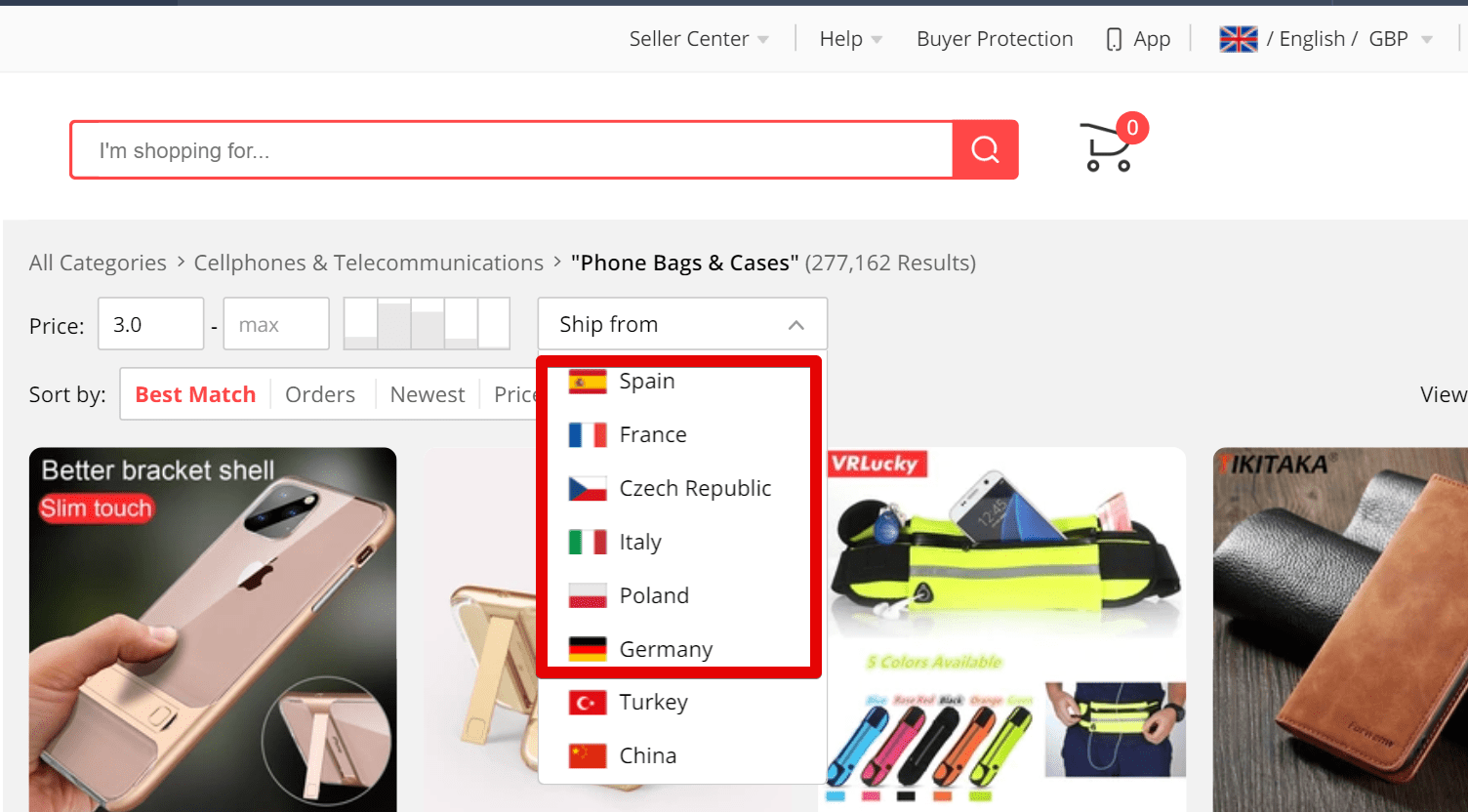

Many AliExpress sellers have warehouses in Spain, Germany, Italy, Poland, Czech Republic, and France. All these countries are close at hand to the UK. Such options are often free and take about two weeks, which is much faster than other alternatives. So, you can easily find these suppliers and speed up the delivery.

Even if you can’t find faster shipping for products you want to dropship and have to use standard options, make sure you notify customers of the delivery time. Otherwise, you’ll have to deal with a lot of complaints from clients who didn’t expect to wait for so long.

#3 What taxes do I need to pay when dropshipping in the UK?

Another common question is do you have to pay taxes on dropshipping to the UK. And the answer is of course you do!

The United Kingdom, like many other developed countries, has a complex tax system. And it’s hard to cover the whole issue in one article.

Yet, there are four main types of obligatory payments every UK ecommerce entrepreneur has to deal with while dropshipping in the UK.

- Income tax

- Sales tax

- VAT on products

- Customs Duty

Income tax

Income tax is a tax that the UK government imposes on your earnings. In other words, it’s the share of your income you must pass to HM Revenue & Custom.

Great Britain has a progressive tax system. That means that your income can be divided into four parts called bands. And each band has its own name and tax rate. Here they are, according to the UK government’s official website:

- Personal allowance: 0% for your income up to £12,500

- Basic rate: 20% – £12,501 to £50,000

- Higher rate: 40% – £50,001 to £150,000

- Additional rate: 45% for the income over £150,000

So, you pay different percentages from different parts of your income. For example, if you earn £65,000, you pay nothing for the first £12,500, 20% (£7,500) for the next £37,500 you’ve made, and 40% (£6,000) for the rest £15,000 of your income. The total sum you need to give for your £65,000 is £13,500.

Besides, if you live in Scotland, you must pay your taxes to the Scottish government, which sets slightly different bands to tax your income. You can see them below:

- Personal allowance: 0% for your income up to £12,500

- Starter rate: 19% – £12,501 to £14,549

- Basic rate: 20% – £14,500 to £24,944

- Intermediate rate: 21% – £24,945 to £43,430

- Higher rate: 41% – £43,431 to £150,000

- Top rate: 46% for the income over £150,000

Customs duty and VAT on dropshipping in the UK

VAT, or value-added tax, is a consumption tax assessed on the value added to goods and services. It’s used in many countries including the United Kingdom.

Now that the kingdom has left the EU, customs and tax regulations have changed. So if you want to start or continue dropshipping after Brexit, here’s what you should know.

Do you need to register a dropshipping business for VAT?

Yes, any business that sells goods sent from overseas directly to UK customers without using online marketplaces must register for the VAT to HMRC.

So, businesses dropshipping from China to the UK definitely must register. The same goes for dropshippers that sell goods from EU countries.

Previously, businesses were exempt from VAT and didn’t have to register unless their yearly revenue is below £85,000. But you must register for VAT no matter what revenue your business makes.

Changes to UK VAT tax

Previously, if the cost of a consignment of goods did not exceed £15, you didn’t have to pay customs or import VAT. Now Low Value Consignment Relief has been abolished. In other words, you still have to charge VAT for such consignments.

If the value of a consignment of goods does not exceed £135, you have to pay VAT, but no customs duty is charged. However, while previously, the government collected VAT at the point of importation, now the tax is collected at the point of sale.

For an ecommerce store, the point of sale is its payment gates (Stripe, PayPal, etc.). It means that the value of the goods is based on the price at which you sell them to customers rather than the value calculated at the point where the products cross the border.

It’s also important to note that the £135 threshold is applied to a consignment of goods, i.e. the whole package, and not to individual items. It, however, excludes transportation and insurance costs or any other taxes and charges.

It means that if you’re going to sell two items at a price lower than £135 each, you’d better send them in two separate packages to benefit from customs duty relief.

If the cost of a consignment of goods exceeds £135, instead of supply VAT, you will have to pay import VAT at the border, as well as customs duty.

Follow this link to learn more about the changes to the UK VAT system.

VAT and customs duty rates

The standard VAT rate is 20%, while the reduced rate equals 5% (for some categories of goods). Some products are exempt from VAT. You can see VAT rates for different goods here.

As for customs duty, it’s zero for consignments under £135 in value. For consignments that cost £135-£630, you will have to pay 2.5% in most cases. For consignments above the £630 threshold, the rate can be different. You’ll have to consult the UK government’s helpline to learn more.

Please note: the information we give you on tax requirements and regulations cannot be considered as legal advice. To handle your taxes properly in full accordance with the country’s law, we recommend you consult your local lawyer.

#4 Is there anything tricky about UK dropshipping?

As you can see, the consequences of Brexit for overseas sellers aren’t exactly positive. By leaving the European Union, Great Britain made it harder for foreign companies to sell goods in the kingdom.

Previously, one could dropship products from warehouses located in Europe, but now this maneuver won’t change anything.

Nevertheless, UK dropshipping remains a popular business idea. And despite the new rules, one can still make money by selling goods to locals. But you’ll have to adapt.

First of all, despite Brexit, you should still dropship goods from European warehouses whenever possible. You will still have to pay taxes, but it’ll considerably shorten your shipping time.

I also recommend being honest with your clients. To keep your customers’ anger at bay and avoid a misunderstanding, you should let your UK clients know about the possible fees they could encounter.

#5 What about dropshipping to other countries?

Unlike many other business models, dropshipping is easier to start and run. But there are other features that make it so great.

One of them is the ability to sell products to any country you want or to several countries at once. Your dropshipping store doesn’t have to be confined to UK customers. With AliExpress sending goods to almost any destination on the planet, you can sell internationally.

You can easily find an AliExpress supplier that has warehouses in Europe and sell your products to any EU country. Your customers won’t face any unexpected payments.

You can also successfully target such countries as the USA and Australia. AliExpress sellers store their goods there as well.

If you choose a country like Canada, which has a low limit on online purchases ($20), you should warn your clients in advance about the extra fees they may face. However, there is some loophole in the case of Canada.

In 2018, the USA and Canada made a new trade deal. And now, Canadian customers can buy online up to $150 from the United States and pay no customs duty (although taxes are still applied if the cost is above $40).

So, if you choose an AliExpress seller with a warehouse in the USA, you can make good use of that.

We hope this article will help you get your head around UK dropshipping and start your online business. If you have more questions, please leave them in the comment section below. We’re always happy to lend you a hand.

tutorials and special offers from AliDropship

thankyou for the information you have sent me it is really useful,l I would just like to make sure that I have interpreted it correctly

1 II don’t need to register for V.A.T until my store gets close to £70.000.

2 I don’t need to contact the income tax and register as a sole trader until my store is nearing £12500.

If I am correct in both of these areas things are looking good!

could you please let me know if I am correct and would be able to set up an online store just one other thing if I am selling in the uk for example would customers be able to pay by debit, visa and credit card or even Pay Pal

regards martin

Hi, thank you for your interest! Our dedicated team member will get in touch with you soon.

Hello Martin, I am in an exact startup situation as you. Fid you manage to get clarification on the VAT and TAX issue as per your comment? These were the two points:

1 II don’t need to register for V.A.T until my store gets close to £70.000.

2 I don’t need to contact the income tax and register as a sole trader until my store is nearing £12500.

hello I’m still learning and not ready to start . so we will need an accountant to simplify tax and v.a.t?

thanks

Hi, thank you for your interest!

You may need to consult a tax specialist once, before you start the business, but it’s not necessary to hire an accountant on a permanent basis.

HI, What if drop shipper is in India and (registered in india) willing to sell UK customers? How Registration and taxes apply in that case?

Hi, thank you for your question!

From the experience of one of our clients, Asif from India, we know that he pays ITR and GST. You can read his whole story and comments here: https://work10.alidropship.com/dropshipping-india-success-story/

He also runs a thread on AliDropship forum: https://forum.work10.alidropship.com/threads/a-little-bit-about-me-and-my-dropship-journey.2341/ – feel free to read it to learn more about other aspects of dropshipping in India!

Hi!

In the start- should all new dropshippers register as a sole trader rather than a limited company

Hi, Nyrah!

Sole Trader is the simplest business structure compared to others. In this case, you’re the sole owner of your business and it’s easy to set up. For comparison, a Limited Company has its own legal identity separate from its owner(s) or manager(s). It also has separate finances from your personal ones. All this makes Limited Company a more complicated business structure suitable for larger businesses.

It’s up to you to decide which one to choose, but we recommend Sole Trader because it’s simpler.

Hi Timur

Thank you for your update on UK Vat. As of Jan 1 2021 I understand my website will need to include and charge 20% VAT. I dropship with Aliexpress and since Jan 1 Aliexpress are now also charging an additional 20%.

This means my cost of goods has increased by 20%, and I need to charge my customers 20% (VAT) more too. So my coats are now 40% more. In this scenario it seems both Aliexpress and my website are paying VAT. Vat is being payed twice?

Is there any way around this? Can we tell Aliexpress that we are paying the UK VAT and not charge us 20% extra?

Thanks

Ryan

Hi, Ryan.

As far as I can tell, AliExpress is charging VAT because of the changes in the rules. But it is charged when an AliExpress seller sells products to UK customers. In case of dropshipping, it’s B2B. This is what the rules say about it:

“Business to business sales not exceeding £135 in value will also be subject to the new rules. However, where the business customer is VAT registered in the UK and provides its valid VAT registration number to the seller, the VAT will be accounted for by the customer by means of a reverse charge.”

So, if your dropshipping business is VAT registered in the UK, the AliExpress supplier should not charge any VAT. Instead, you will have to pay the VAT. And here’s another abstract:

“Where the UK VAT registered business provides the OMP or direct seller with its VAT registration number, the responsibility to account for VAT will switch to the UK VAT registered business customer, who will account for it by means of a reverse charge procedure. So the OMP or direct seller will not be liable to account for the VAT in these circumstances.”

AliExpress is an Online Market Place, so again, they should not charge any VAT. So, in theory, double taxation should not happen. You can learn more here: https://www.gov.uk/government/publications/changes-to-vat-treatment-of-overseas-goods-sold-to-customers-from-1-january-2021/changes-to-vat-treatment-of-overseas-goods-sold-to-customers-from-1-january-2021

Nevertheless, cases of double VAT are not uncommon but happen due to mistakes. I strongly recommend contacting your AliExpress suppliers and asking them how they work and what exactly you should do to avoid double taxation.